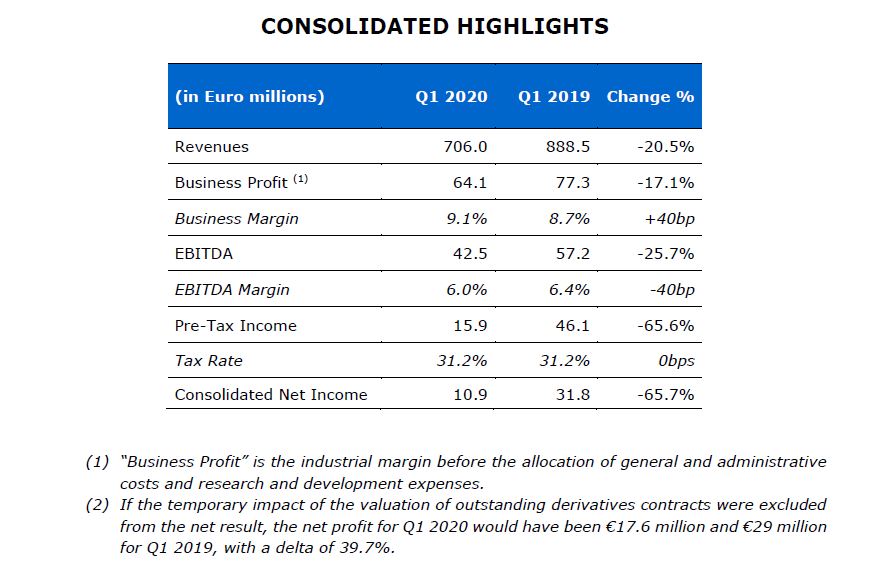

• Revenues: €706.0 million

• EBITDA: €42.5 million

• Backlog: €6.1 billion

• Covid-19: Business continuity ensured by a flexible organizational model and processes’ digitalization

• Launched cost savings initiatives worth about €60 million

• The recent further acquisition of the €1.2 billion Amur Gas Chemical Complex contract reflects the resilience of the petrochemical business in a particularly challenging period

Milan, 7 May 2020 – Maire Tecnimont S.p.A.’s Board of Directors today has reviewed and approved the Interim Financial report as at 31 March 2020 which reports a Net Income of €10.9 million.

Covid-19

The explosion of the emergency triggered by the Covid-19 pandemic has presented major business and financial challenges. The general level of uncertainty and consequent dramatic and widespread drop in demand for services has driven many of the sector’s leading players to considerably review their future investment plans.

As a result of increasingly restrictive protective measures put in place by governments in countries affected by the pandemic, the Group experienced an impact on its operating processes that became evident during the month of March. This impact was due to limitations on the mobility of professional staff working on projects, as well as effects on the supply chain after manufacturing companies interrupted their production of materials and components. The stringent measures taken to prevent the spread of the pandemic sometimes also led to a slowdown in construction activities, and, in limited cases, to site closures.

The health and safety of employees is the Group’s top priority. The Group at first responded promptly to the emergency by taking steps to manage and contain the pandemic’s spread.

Once all health protection measures had been put in place, work activities were reorganized quickly in order to offset the effects of the restrictions wherever possible. The flexible organizational model, the digitalization of processes, and the advanced collaboration between partners and clients enabled us to mitigate the impact on our operations. Commercial activities also continued, enabling us to sign new contracts thanks to the Group’s ability to work remotely. All of our support activities, in fact, continued without interruption, thanks to a successful smart working model that made it possible to meet all business needs.

Consolidated Financial Results as at 31 March 2020

Maire Tecnimont Group Revenues were €706.0 million, down 20.5%. Volumes still reflect the non-linear progress of projects in the backlog, depending on the planned schedules for each project. As highlighted starting from the second half of 2019, volumes reflect both the final stage of some EPC projects awarded over the past years, not yet compensated by new acquisitions, and the type of contracts that were recently acquired, mainly Engineering, Procurement, Construction Management and Commissioning services, that due to their nature, generate lower volumes.

Furthermore, as already stated, First Quarter Revenues also reflect the slowdown of operations in certain geographies, in particular in the second half of March following the decisions taken by various Governments in order to contain the Covid-19 pandemic.

Business Profit was €64.1 million, down 17.1%. Business Margin was 9.1%, up versus 8.7%, as a result of the temporary change in the project mix that were executed in the First Quarter.

G&A costs were €19.7 million, or 2.8% of revenues, slightly up, due to the strengthening of Group’s entities in some geographical areas, as well as the strengthening of NextChem’s operations in the Green Energy business unit.

EBITDA was €42.5 million, down 25.7%, due to lower volumes in the quarter, and a higher share of fixed costs. The margin was 6.0%, slightly down from 6.4%.

Amortization, Depreciation, Write-downs and Provisions were €11.2 million, substantially unchanged.

EBIT was €31.3 million, down 31.9%. Margin decreased from 5.2% to 4.4%

Net Financial Charges were €15.4 million, down by €15.6 million versus a positive value €0.2 million. The change is mainly due to a negative net valuation of certain derivative contracts for €9.6 million vs. a positive value of €3.9 million. This valuation was negatively impacted by an unfavorable exchange rate performance of the Russian Ruble and the US Dollar versus the Euro, caused by the pandemic’s impact on the FX markets. Excluding derivatives, Financial Charges showed a slight improvement.

Pre-tax Income was €15.9 million, down 65.6%. Estimated taxes of €4.9 million have been provisioned.

The effective tax rate was approx. 31.2%, in line with the average normalized tax rate of the last few quarters, taking into account the various jurisdictions where Group operations have been carried out.

Consolidated Net Income was €10.9 million, down 65.6%. If the temporary impact of the valuation of outstanding derivatives contracts were excluded from the net result, the net profit for Q1 2020 would have been €17.6 million and €29 million for Q1 2019, with a delta of 39.7%.

Net Debt (net of the above-mentioned value in the table footnote) at March 31, 2020 was €344.8 million, down compared to a Net Cash of €78.9 million of at 31 December 2019. The decrease is mainly due to the change required by certain EPC projects’ working capital dynamics, which have been characterized by significant payments for equipment and construction activities in the first Quarter. These payments have not been compensated by expected cash receipts which have not taken place due to the spread of Covid-19 which has caused some clients to postpone their scheduled payments and defer the approval process of certain milestones because of their inability to carry out their normal work remotely also referring to certain settlement activities under negotiation. Finally, the aforementioned effects of the pandemic also affected the timing of the assignment of new projects with the consequent deferment of the collection of contractual advances. At 31 March 2020, this item has also been negatively impacted by a €63.1 million mark-to-market valuation of the derivative contracts, mainly due to the performance of the Euro vs. the US Dollar and the Russian Ruble, and by cash taxes equal to €8.8 million.

Consolidated Shareholders’ Equity was €413.7 million, down €35.3 million vs. December 31, 2019. This increase was driven by a negative change of the derivatives’ Cash Flow Hedge reserve related to the negative mark to market of the derivatives hedging the projects’ flows, net of the fiscal effect of €25.4 million, and of the negative amount of €21.3 million related to the translation of the financial statements reported in a foreign currency.

Performance by Business Unit

Hydrocarbons BU

Revenues were €689.0 million, down 19.5%, due to the same reasons commented above.

Business Profit was €63.9 million, down 14.4%, leading to a Business Margin of 9.3%, up vs. 8.7%. EBITDA was €43.8 million, with a margin of 6.3%, down vs. 6.6%, mainly due to the lower volumes in this quarter, and to a higher share of the fixed costs.

Green Energy BU

Revenues were €17.0 million, down 47.8%, due to the end of a few contracts for large-scale plants in the renewable energy sector, not yet replaced by new acquisitions, and also due to the final phase of a project in the hospital sector. At the same time, our subsidiary NextChem, active in the Circular Economy and the energy transition, has recorded a slight increase in its activities. Business Profit was €0.2 million, down vs. €2.7 million. The Business Margin was 1.2% vs. 8.2% due to the lower volumes and higher commercial costs. EBITDA was negative €1.2 million, compare to a positive result of €1.1 million.

Order Intake and Backlog

Thanks to €458,9 million of new orders generated in Q1 2020, the Group’s Backlog at March 31, 2020 was €6,141.7 million.

In particular, the main projects awarded to the Group include the following:

• an EPC contract from Gemlik Gubre, part of Yildirim Holding, for the implementation of a new Urea and Urea Ammonium Nitrate solution plant in Gemlik, Turkey, for approximately €200 million.

• New contracts for a total amount of approximately €220 million in the core business, mainly in Europe, including an EPCC contract signed with Total for the construction of a new Hydrotreatment unit to be realized in the Donges’ refinery in France.

• New awards by top-notch clients including Borealis and Lukoil for feasibility, FEED and detailed engineering services for about USD10 million.

Subsequent Events

• On April 30, 2020, Maire Tecnimont S.p.A Shareholder’s Meeting has approved:

- The Financial Statements as at 31 December 2019;

- The Board of Directors' proposal to carry forward the year’s net income;

- The Remuneration Policy for 2020 and second section of the "Report on the 2020 Remuneration Policy and fees paid";

- The Conversion of the 2019-2021 LTI Plan;

- The 2020-2022 LTI Plan;

- The 2020-2022 Employees Share Ownership Plan, and

- The 2020-2024 NextChem Investment Plan.

• On May 5, 2020, Maire Tecnimont announced that its subsidiary Tecnimont S.p.A., as majority leader of a consortium, signed an Engineering, Procurement and Site Services contract with Amur GCC LLC, part of PJSC Sibur Holding, for the petrochemical development of the Amur Gas Chemical Complex (AGCC). AGCC is the downstream expansion of the Amur Gas Processing Plant (AGPP), a package of which Maire Tecnimont Group is currently executing in the Amur region in the Far East of the Russian Federation. The contract’s overall value is approximately €1.2 billion, the significant majority of which pertains to the Maire Tecnimont Group.

Outlook

At present, in view of the development of the “Coronavirus” and the consequences that it may have on the global general economy, the Group is continuing to assess the possible financial and operating impacts over the upcoming quarters of 2020, taking into account that such emergency could reasonably slowdown and conclude in the coming months, while also considering the restart measures planned by the governments and central banks of the countries affected by the spread of the virus.

Despite uncertainty over the impacts of Covid-19 and consequences for the oil price and its derivatives, the market has seen continued investment in the downstream segment. Through global and diversified operations and with the technological infrastructure that the Group has had in place for some time - the benefits of which have been extensively demonstrated in this period of major crisis - it is expected that the complexities of 2020 will be faced in a structured and competitive manner.

In terms of a management structure reaction to the contingent situation from Covid-19, the Group has launched several initiatives - some of which representing a structural change in the traditional way of providing excellent services - which will generate a total saving of approximately €60 million.

In addition to boosting the Group’s competitiveness, these savings - which can be achieved starting in the current year – together with the settlement of negotiations under way with clients – could contribute to a progressive normalization of the net working capital with a consequent improvement in the financial position.

Considering all the above, and in light of the approval by shareholders on 30 April 2020, the Board of Directors - upon an initiative of the Top Management which has been positively met by the Remuneration Committee and after consulting the Board of Statutory Auditors, as per its competences – taking a prudent approach, resolved to suspend the delivery of the Maire Tecnimont shares to the Beneficiaries of the 2017-2019 Restricted Stock Plan, and, with reference to the Incentive and Investment Plans approved by the Shareholders' Meeting on 30 April 2020, and notwithstanding the 2020 Remuneration Policy, also resolved not to implement the 2020-2022 Long Term Incentive Plan, and to suspend for this fiscal year the assignment of the objectives related to the short term incentive plans (MBOs).

***

Webcast Conference Call

The First Quarter 2020 Financial Results will be presented today at 5:30pm CEST during an audio-webcast conference call held by the top management.

The conference call may be followed as a webcast by connecting to the website (www.mairetecnimont.com) and clicking on the “Q1 2020 Financial Results” banner on the Home Page or through the following url:

https://87399.choruscall.eu/links/mairetecnimont200507.html

Alternatively, you may participate in the conference call by calling one of the following numbers:

Italy: +39 02 805-8811

UK: +44 121 281-8003

USA: +1 718 705-8794

The presentation given by the top management will be available at the start of the conference call in the “Investors/Results and Presentations/Financial Results” section of Maire Tecnimont’s website

(https://www.mairetecnimont.com/en/investors/results-and-presentations/financial-results). The presentation shall also be made available on the 1info storage mechanism (www.1info.it).

***

Dario Michelangeli, as Executive for Financial Reporting, declares - in accordance with paragraph 2, Article 154-bis of Legislative Decree No. 58/1998 (“Consolidated Finance Act”) - that the accounting information included in this press release corresponds to the underlying accounting records.

The Interim Financial Report as at 31 March 2020 will be available to the public at the registered office in Rome, at the operative office in Milan, on the Company’s website www.mairetecnimont.com (in the “Investors/Results and Presentations/Financial Results” section, and on the authorized storage device “1info” (www.1info.it), according to the timing allowed by law.

This press release, and the “Outlook” section in particular, contains forecasts. The declarations are based on current estimates and projections of the Group concerning future events and, by their nature, are subject to risk and uncertainty. Actual results may differ significantly than the estimates made in such declarations due to a wide range of factors, including the continued volatility and further decline of the capital and finance markets, raw material price changes, altered economic conditions and growth trends and other changes in business conditions, in addition to other factors, the majority of which outside the control of the Group.

Maire Tecnimont S.p.A.

Maire Tecnimont S.p.A., a company listed on the Milan Stock Exchange, is at the head of an international industrial group leader in the transformation of natural resources (plant engineering in downstream oil & gas, with technological and execution competences). Through its subsidiary NextChem it operates in the field of green chemistry and the technologies to support the energy transition. Maire Tecnimont Group operates in about 45 countries, numbering around 50 operative companies and a workforce of approximately 6,500 employees, along with approximately 3,000 professionals in the electro-instrumental division. For more information: www.mairetecnimont.com.

Institutional Relations and Communication

Carlo Nicolais, Tommaso Verani,

Ida Arjomand

public.affairs@mairetecnimont.it

Media Relations

Image Building

Alfredo Mele, Carlo Musa,

Alessandro Beretta

Tel +39 02 89011300

mairetecnimont@imagebuilding.it

Investor Relations

Riccardo Guglielmetti

Tel +39 02 6313-7823

investor-relations@mairetecnimont.it