- Revenues: €2.4 billion

- EBITDA: €168.7 million

- Working Capital and Net Financial Position have improved

- Highest ever commercial pipeline equal to €46.0 billion

- Finalized agreement to dispose the Alba/Bra hospital project (Green Energy BU)

- Guidance 2019

- Updated Revenues: about €3.4 billion (from €3.8 billion

- Confirmed EBITDA: about €210 million (ex-IFRS 16), with the marginality up from 5.5% to 6.2%

- Confirmed Net Cash: €80-100 million

Milan, 24 October 2019 – Maire Tecnimont S.p.A.’s Board of Directors today has reviewed and approved the Interim Financial Report as at 30 September 2019 which reports a Consolidated Net Income of €82.5 million.

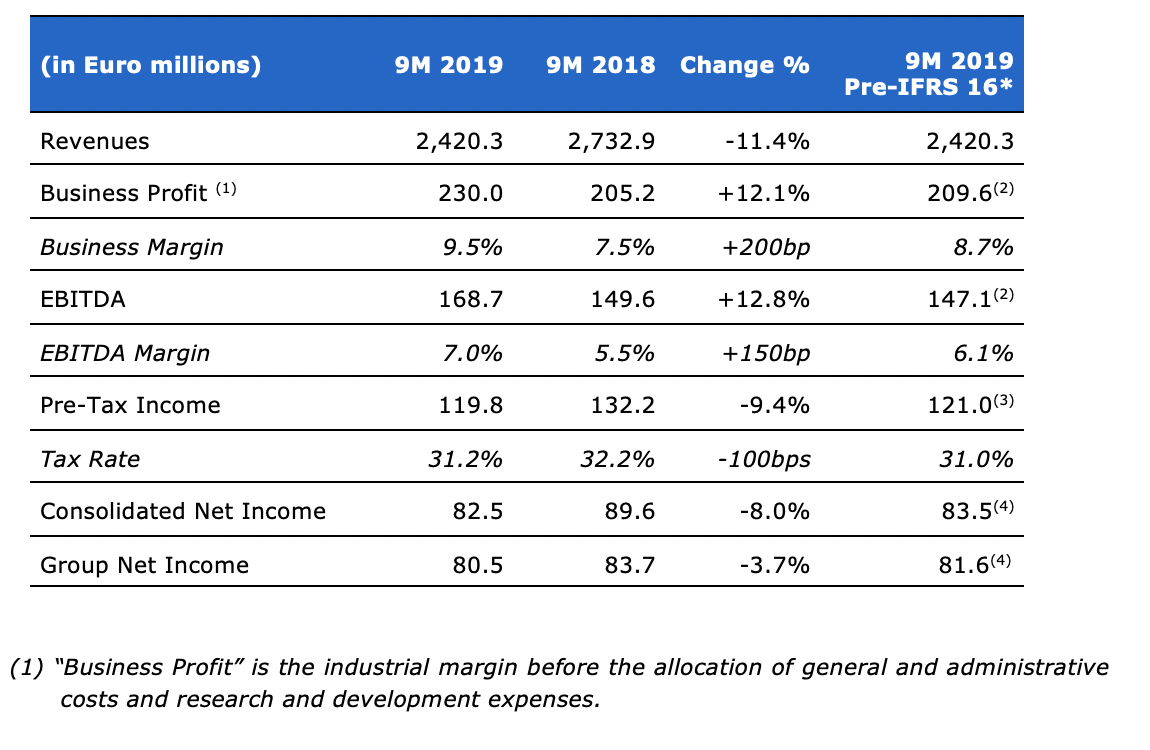

CONSOLIDATED HIGHLIGHTS

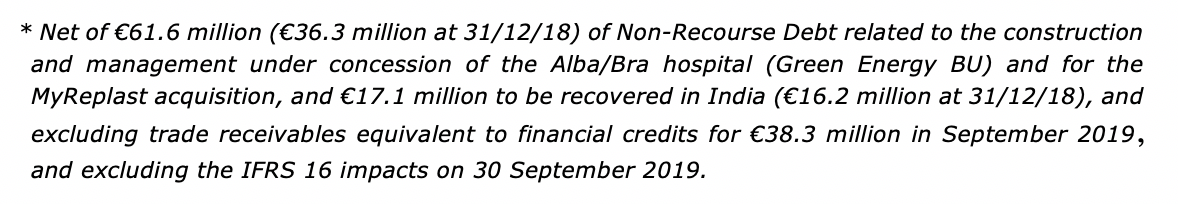

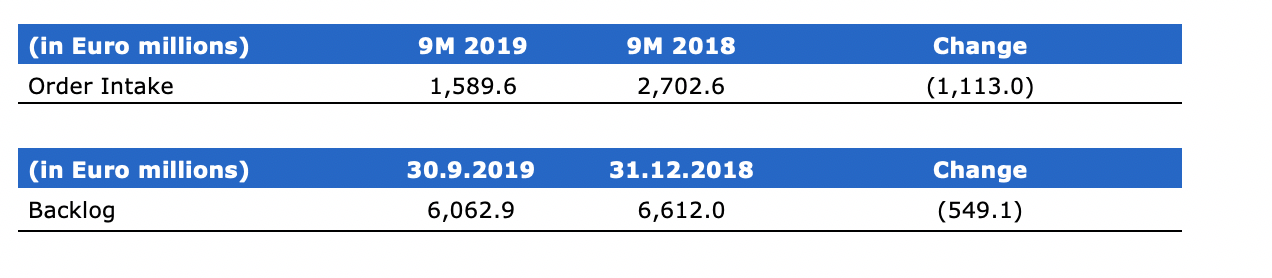

ORDER INTAKE AND BACKLOG

FINANCIAL HIGHLIGHTS BY BUSINESS UNIT

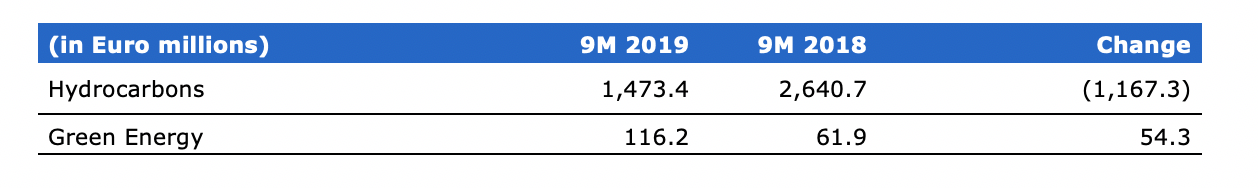

ORDER INTAKE BY BUSINESS UNIT

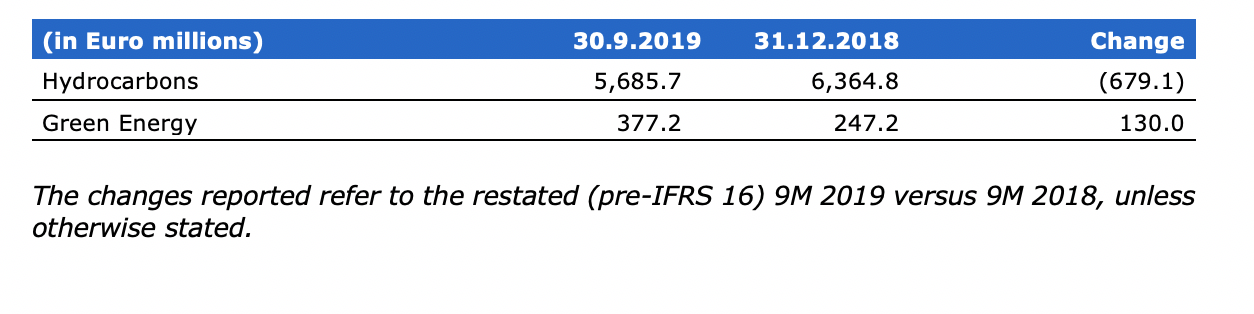

BACKLOG BY BUSINESS UNIT

Consolidated Financial Results as at 30 September 2019

Maire Tecnimont Group Revenues were €2,420.3 million, down 11.4%. Volumes reflect the non-linear progress of projects in the backlog, depending on the planned schedules for each project. In particular, Q3 volumes reflect the final stages of the main EPCs awarded over the past years, not yet compensated by new acquisitions that are still in their initial phases, and the temporary phasing of some EPC projects. Volumes also reflect the type of contracts that were recently acquired, mainly Engineering, Procurement, Construction Management and Commissioning, that generate lower volumes. Revenues in the last quarter of 2019 are expected to increase in line with the projects’ planned schedules.

Restated Business Profit was €209.6 million, up 2.2%. The restated Business Margin was 8.7%, up versus 7.5%, as a result of the temporary change in the backlog mix.

G&A costs were €57.8 million, or 2.4% of revenues, up compared to the first nine months of 2018, but substantially in line with the first semester of 2019.

Restated EBITDA was €147.1 million (€168.7 million including the IFRS 16 impact, up +12.8%), down 1.7%, due to lower volumes in the period. The restated margin was 6.1%, up from 5.5%, for the same reasons detailed above.

Amortization, Depreciation, Write-downs and Provisions were €16.8 million, up compared to the same period of 2018, mainly due to the amortization of new assets related to the Group's activities, the amortization of plants and machineries following the acquisition of MyReplast Industries by the subsidiary NextChem in 2019 and the provisions on receivables related to old real estate initiatives.

Restated EBIT was €130.3 million, down 8.9%, due to the increase of the previous item.

Restated Net Financial Charges were €9.3 million, improving by €1.6 million. The 9M19 data is mainly impacted by the positive contribution of the net valuation of derivatives equal to €1.1 million; such valuation was negative for €1.9 million in 9M 2018.

Restated pre-tax Income was €121.0 million, down 8.5%. Estimated taxes of €37.5 million have been provisioned.

The effective tax rate was approx. 31.0%, down compared to 32.2% and to the average normalized tax rate of the last few quarters, taking into account the various jurisdictions where Group operations have been carried out.

Restated Consolidated Net Income was €83.5 million, down 6.8%.

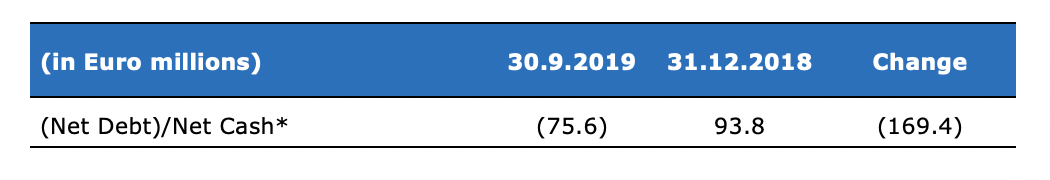

Net Debt (net of the above-mentioned value in the table footnote) at September 30, 2019 was €75.6 million, down compared to €93.8 million of Net Cash at 31 December 2018. This change is mainly due to the expected change in working capital as a result of the normal progress of the projects, in particular EPCs that are substantially completed, as well as the type of the recently acquired contracts. Operating cash flows are also impacted by a dividend payment of €39.1 million and cash taxes equal to €32.7 million.

Consolidated Shareholders’ Equity was €413.4 million, up €60.1 million vs. December 31, 2018, thanks to the income for the period, and to a positive change of the derivatives’ Cash Flow Hedge reserve related to the positive mark to market of the derivatives hedging the projects’ flows, net of the fiscal effect and of the translation of the financial statements reported in a foreign currency, and taking into account a dividend payment of €39.1 million related to 2018.

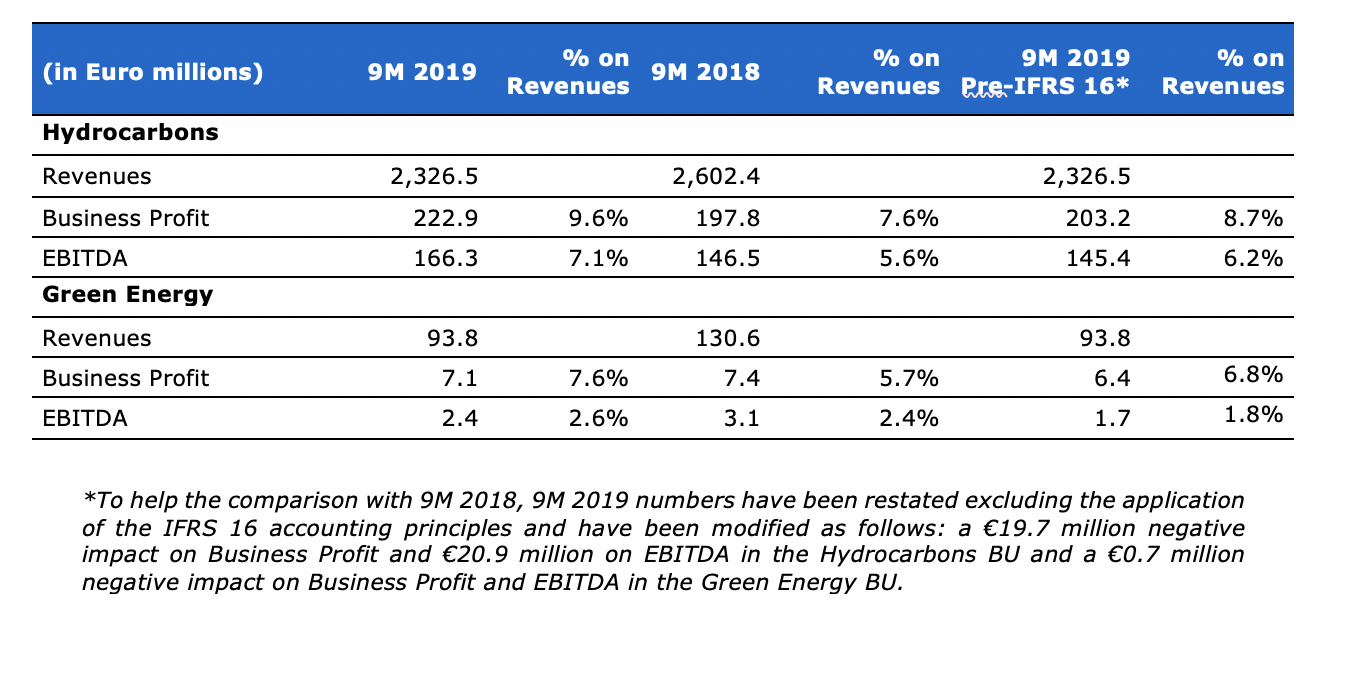

Performance by Business Unit

Hydrocarbons BU

Revenues were €2,326.5 million, down 10.6%, due to the same reasons commented above.

Restated Business Profit was €203.2 million, up 2.7%, leading to a restated Business Margin of 8.7%, up vs. 7.6%. Restated EBITDA was €145.4 million, with a marginality of 6.2%, up vs. 5.6%.

Green Energy BU

Revenues were €93.8 million, down 28.1%, due to the end of a few contracts for large-scale plants in the renewable energy sector, not yet replaced by new acquisitions, and due to the final phase of a project in the hospital sector. At the same time, our subsidiary NextChem, active in the Circular Economy, started its operations after its first investment in the advanced mechanical plastic recycling plant. Restated Business Profit was €6.4 million, down 13.5%. The restated Business Margin was 6.8% vs. 5.7%. Restated EBITDA was €1.7 million, down vs. €3.1 million.

Order Intake and Backlog

Thanks to €1,589.6 million of new orders generated during the first Nine Months, the Group’s Backlog at September 30, 2019 was €6,062.9 million.

In particular, the main projects awarded to the Group include the following:

• A reimbursable EP contract for Exxon Mobil for the implementation of new innovative process units in Baytown petrochemical complex

• An EPC contract awarded by a subsidiary of ENI to realize the upgrading of the Luanda refinery in Angola

• An EPC project from ANWIL, for the implementation of a new granulation unit in Poland to produce various types of fertilizers

• A licensing, Process Design Package (PDP) and Proprietary Equipment supply for a Urea plant for ShchekinoAzot in Russia

Subsequent Events

• On October 18th, 2019 an agreement was reached for the disposal of the subsidiary MGR Verduno 2005 S.p.A. (“MGR”) to a primary infrastructure investment fund. MGR owns the concession to manage the Alba/Bra hospital, located in Verduno (Piedmont). Construction of the hospital ended on September 21st, 2019. This agreement is subject to the required legal disclosures and to the financing banks’ approval.

Outlook

The Group continues to maintain a high backlog at the end of September 2019. Thanks to the contracts already signed with international clients since the beginning of the current year, the Group will experience an improved industrial performance in the following quarters, in line with the projects’ planned schedules. 2019 revenues are thus expected to be slightly lower than in 2018, due to the new order intake, which is still in the initial engineering phase, and due to the type of the recently acquired contracts, which mainly relate to services for Engineering, Procurement, Construction Management and Commissioning, which generate lower revenues. On the other hand, the higher percentage of these type of contracts is expected to lead to higher margins than last year, which was characterized by a higher percentage of EPCs.

The market environment is expected to continue favoring a high level of investments in the downstream sector. This is confirmed by an all-time high commercial pipeline, both in the traditional geographical areas where the Group operates, and in new areas characterized by stable economies and raw materials availability.

As for the Green Acceleration Project, Maire Tecnimont is currently active in the Circular Economy sector, through its subsidiary NextChem, thanks to the investment made this year in the most efficient and advanced plastic mechanical recycling plant in Europe. The plant is located in Italy, and has already become a reference plant with an industrial scale size to support expected important domestic and international market opportunities.

***

Webcast Conference Call

The 9M 2019 financial results will be presented today at 5:30pm CEST during an audio-webcast conference call held by the top management.

The conference call may be followed as a webcast by connecting to the website (www.mairetecnimont.com) and clicking on the “9M 2019 Financial Results” banner on the Home Page or through the following url:

https://services.choruscall.eu/links/mairetecnimont191024.html

Alternatively, you may participate in the conference call by calling one of the following numbers:

Italy: +39 02 805-8811

UK: +44 121 281-8003

USA: +1 718 705-8794

The presentation given by the top management will be available at the start of the conference call in the “Investors/Results and Presentations/Financial Results” section of Maire Tecnimont’s website

(https://www.mairetecnimont.com/en/investors/results-and-presentations/financial-results). The presentation shall also be made available on the 1info storage mechanism (www.1info.it).

***

Dario Michelangeli, as Executive for Financial Reporting, declares - in accordance with paragraph 2, Article 154-bis of Legislative Decree No. 58/1998 (“Consolidated Finance Act”) - that the accounting information included in this press release corresponds to the underlying accounting records.

The Interim Report at September 30, 2019 will be available to the public at the registered office in Rome, at the operative office in Milan, at Borsa Italiana S.p.A., on the Company’s website www.mairetecnimont.com (in the “Investors/Results and Presentations/Financial Results” section, and on the authorized storage device “1info” (www.1info.it), according to the timing allowed by law.

This press release, and the “Outlook” section in particular, contains forecasts. The declarations are based on current estimates and projections of the Group concerning future events and, by their nature, are subject to risk and uncertainty. Actual results may differ significantly than the estimates made in such declarations due to a wide range of factors, including the continued volatility and further decline of the capital and finance markets, raw material price changes, altered economic conditions and growth trends and other changes in business conditions, in addition to other factors, the majority of which outside the control of the Group.

Maire Tecnimont S.p.A.

Maire Tecnimont S.p.A., a company listed on the Milan Stock Exchange, is at the head of an international industrial group leader in the transformation of natural resources (plant engineering in downstream oil & gas, with technological and execution competences). Through its subsidiary NextChem it operates in the field of green chemistry and the technologies to support the energy transition. Maire Tecnimont Group operates in about 45 countries, numbering around 50 operative companies and a workforce of approximately 6,300 employees, along with approximately 3,000 professionals in the electro-instrumental division. For more information: www.mairetecnimont.com.

Institutional Relations and Communication

Carlo Nicolais, Ida Arjomand

public.affairs@mairetecnimont.it

Media Relations

Image Building

Alfredo Mele, Carlo De Nicola

Tel +39 02 89011300

mairetecnimont@imagebuilding.it

Investor Relations

Riccardo Guglielmetti

Tel +39 02 6313-7823

investor-relations@mairetecnimont.it