• Positive Q1 2019 Results

o EBITDA: €57.2 million (+13.4%)

o Net Income: €31.4 million (+3.1%)

• Improved marginality

o EBITDA Margin from 5.5% to 6.4%

• Increase in Backlog to €6.7 billion

• Started expansion into Green Chemistry

Milan, 9 May 2019 –Maire Tecnimont S.p.A.’s Board of Directors today has reviewed and approved the Interim Financial Report as at 31 March 2019 which reports a Net Income of €31.8 million.

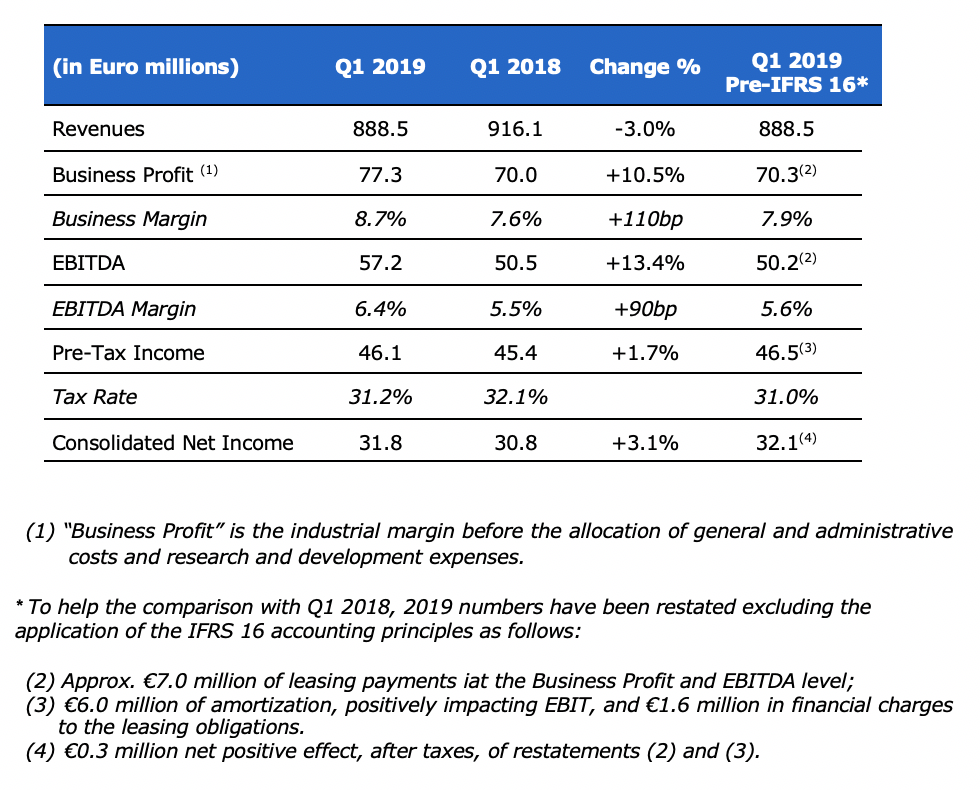

CONSOLIDATED HIGHLIGHTS

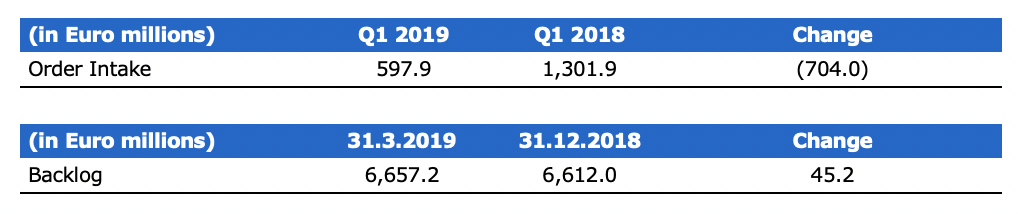

ORDER INTAKE AND BACKLOG

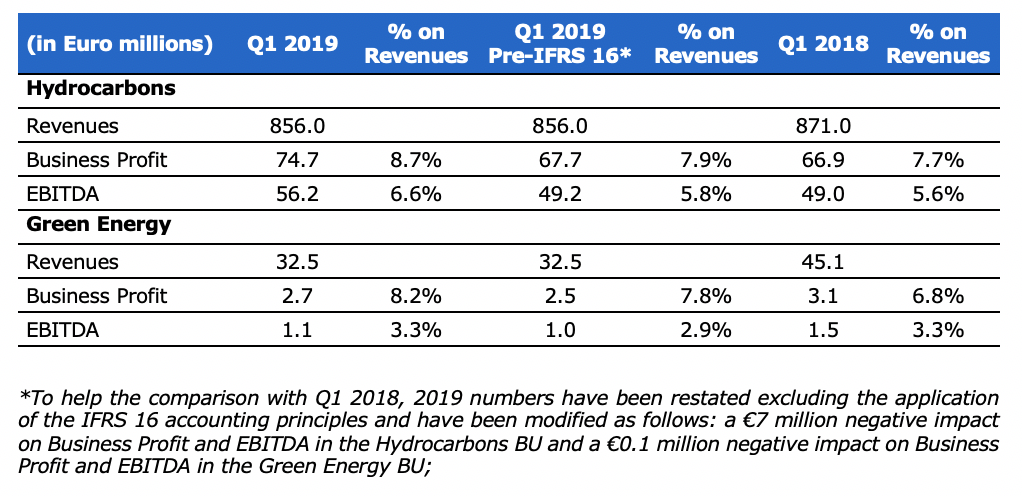

FINANCIAL HIGHLIGHTS BY BUSINESS UNIT

From 1st January 2019, the economic and financial information by Business Unit reflect the new names of Hydrocarbons and Green Energy (respectively Technology, Engineering & Construction, and Infrastructure and Civil Engineering until 31 December 2018)

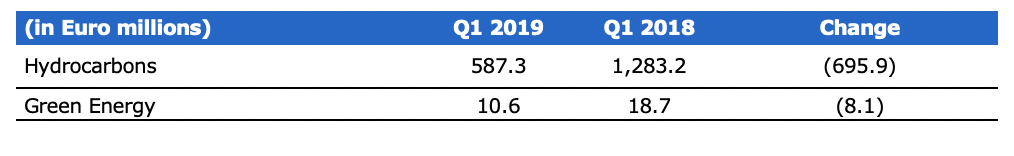

ORDER INTAKE BY BUSINESS UNIT

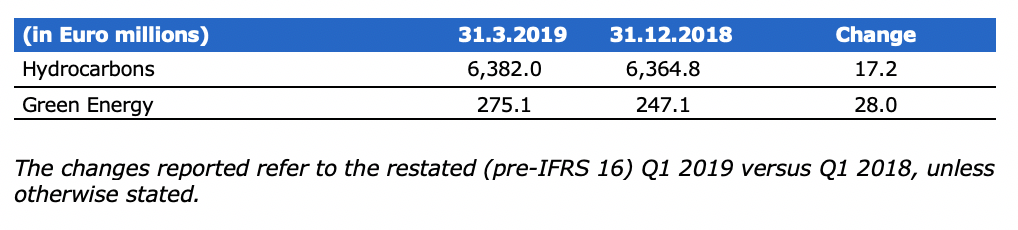

BACKLOG BY BUSINESS UNIT

Consolidated Financial Results as at 31 March 2019

Maire Tecnimont Group Revenues were €888.5 million, down 3%. These volumes are in line with the operating schedules, and the non-proportional evolution over time depends on the projects’ planning and on weather-related factors for a few large contracts. Revenues in the following quarters are expected to increase in line with the projects’ planning.

Restated Business Profit was €70.3 million, up 0.4%. The restated Business Margin was 7.9% versus 7.6%.

G&A costs were €18.6 million, with a costs’ incidence over revenues of about 2.0%, in line with the first quarter of 2018.

Restated EBITDA was €50.2 million, substantially in line. The margin was 5.6%, up from 5.5%.

Amortization, Depreciation, Write-downs and Provisions were €5.4 million, up compared to the same period of 2018, mainly due to the amortization of new assets related to the Group's activities.

Restated EBIT was €44.7 million, equivalent to a 5.0% margin, slightly down versus 5.3%, due to the increase of the previous item.

Restated Net Financial Income was €1.8 million, improving by €5.2 million. The 2019 number is mainly due to a net positive effect of €3.9 million related to the time value of the FX derivatives, which had a negative impact of €0.6 million in Q1 2018. The result net of any FX derivative effect is substantially in line with the previous quarters.

Restated pre-tax Income was €46.5 million, up 2.6%. Estimated taxes of €14.4 million have been provisioned.

The effective tax rate was approx. 31.0%, down compared to 32.1% of the average normalized tax rate of the last few quarters, taking into account the various jurisdictions where Group operations have been carried out.

Restated Consolidated Net Income was €32.1 million, up 4.2%.

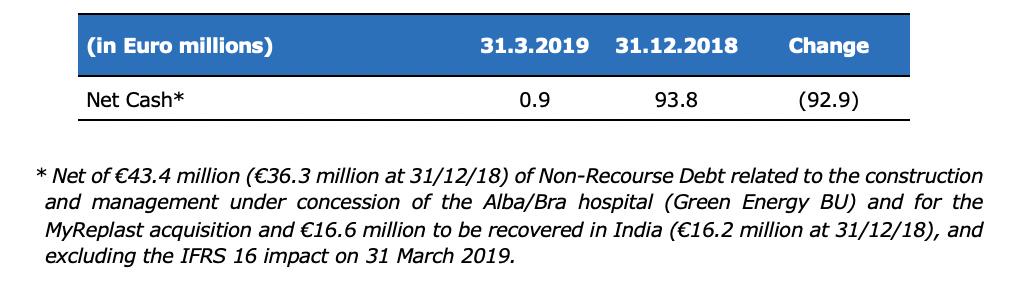

Net cash (net of the above-mentioned value in the table footnote, and excluding the IFRS16 accounting principles effect equal to €157.7 million) at 31 March 2019 was €0.9 million, down compared to €93.8 million at 31 December 2018. This change is mainly due to the expected change in working capital as a result of the normal progress of projects, in particular EPCs that are about to be completed, as well as the type of the recently acquired contracts, which are not EPCs. Such a negative change is partially compensated by a €31.4 million positive FX impact related to the projects’ derivative positions.

Consolidated Shareholders’ Equity was €403.2 million, up €60.6 million vs. December 31, 2018, thanks to the income for the period, and to a positive change of the derivatives’ Cash Flow Hedge reserve related to the positive mark to market of the derivatives hedging the projects’ flows, net of the fiscal effect and of the translation of the financial statements stated in a foreign currency.

Performance by Business Unit

Hydrocarbons BU

Revenues were €856 million, down 1.7%, due to the same reasons commented above.

Restated Business Profit was €67.7 million, up 1.2%, leading to a restated Business Margin of 7.9% (vs.7.7%). Restated EBITDA was €42.9 million (representing a 5.8% margin), up 0.5%.

Green Energy BU

Revenues were €32.5 million, down 28%, due to the end of a few contracts for large-scale plants in the renewable energy sector, not yet replaced by new acquisitions, and the final phase of a project in the hospital sector. At the same time, our subsidiary NextChem, active in the Circular Economy, started its operations following the development of the proprietary technology in the advanced mechanical plastic recycling reference plant.

Restated Business Profit was €2.5 million, down 17.3%. The restated Business Margin was 7.8% vs. 6.8%. Restated EBITDA was €0.9 million, down 36.2%.

Order Intake and Backlog

Thanks to €597.9 million of new orders generated during the period, the Group’s Backlog at March 31, 2019 was €6.657,2 million.

In particular, the main projects awarded to the Group include the following:

• A FEED for a petrochemical complex for Borouge 4 in the UAE

• The reinstatement of the existing Polypropylene Plant located in Yanbu Industrial City, in the Kingdom of Saudi Arabia, for NATPET

• A Fertilizers plant in Russia for Volgafert on an EPC basis

• A PDH plant in Kallo, Belgium, for Borealis on a reimbursable basis

• The first phase of a refinery revamping project in Port Harcourt, in Nigeria, for NNPC

Subsequent Events

• On 29 April 2019, Maire Tecnimont S.p.A Shareholder’s Meeting has:

- Approved the Financial Statements at 31 December 2018

- Approved the proposed distribution of a dividend equal to €39,108,211.41

- Appointed the new Board of Directors and the new Board of Statutory Auditors for the period 2019-2021, confirming Fabrizio Di Amato as Chairman of the Board of Directors

- Expressed favorable vote to Section One of the 2019 Remuneration Report

- Authorized the purchase and use of Treasury Shares up to a maximum of 2 million ordinary shares

- Approved the amendment of the financial terms related to the appointment of PricewaterhouseCoopers as the external auditors for the 2016-2024 period, with reference to the 2018-2024 Fiscal Years.

• On 29 April 2019, the new Board of Directors has, inter alia, granted the powers to Chairman Di Amato, and confirmed Pierroberto Folgiero as CEO and General Manager, giving him the relevant powers. The Board has also confirmed the Board Committees and nominated their members.

Outlook

The Group continues to maintain a high backlog at the end of the first quarter of 2019. As a consequence, and also thanks to the contracts already signed with international clients since the beginning of the current year, the Group has ensured an industrial performance in line with the last quarter of 2018. Such a performance is mainly characterized by the execution of EPC projects, which are expected to generate higher volumes as for the projects’ planning and with a marginality in line with this type of contracts.

The market environment is expected to witness an increase of investments in the downstream sector, in particular plants that transform oil and gas into petrochemicals and in the revamping of existing refineries in order to adapt the type and quality of their final products to the new market requirements, which are strongly influenced by recent environmental laws.

In this context, the Group expects to maintain a high level of backlog thanks to the well-recognized technological expertise in the petrochemical and fertilizer sectors, and to its primary competencies in the refining and gas treatment sectors. These competitive advantages are continuously being developed and expanded to include adjacent technologies in synergy with the existing ones, leveraging a flexible business model that can offer even more innovative products and services.

This outlook is supported by a significant commercial pipeline that is expected to generate new contracts in the traditional areas where the Group operates, as well as in new geographies that are economically stable and rich in raw materials.

As for the Green Acceleration project that was announced in November 2018, the Group is currently active in the Circular Economy sector through its subsidiary NextChem, thanks to the development of its proprietary technology in the most efficient and advanced plastic mechanical recycling plant in Europe, that took place in the First Quarter of 2019. The plant is located in Italy and is going to be a reference plant with an industrial scale size to support important domestic and international market opportunities.

The circular economy is one of the three pillars of NextChem’s strategy, while the other two are “Greening the Brown” (mitigating the negative environmental consequences of the oil and gas transformation) and “Green-Green” (developing alternative fuel and plastic products using renewable sources), where NextChem owns proprietary technologies or exclusive agreements to develop third-party technologies, to be further commercially developed in 2019.

***

Webcast Conference Call

The Q1 2019 financial results will be presented today at 5:30pm CET during an audio-webcast conference call held by the top management.

The conference call may be followed as a webcast by connecting to the website (www.mairetecnimont.com) and clicking on the “Q1 2019 Financial Results” banner on the Home Page or through the following url:

https://services.choruscall.eu/links/mairetecnimont190509.html

Alternatively, you may participate in the conference call by calling one of the following numbers:

Italy: +39 02 805-8811

UK: +44 121 281-8003

USA: +1 718 705-8794

The presentation given by the top management will be available at the start of the conference call in the “Investors/Results and Presentations/Financial Results” section of Maire Tecnimont’s website

(https://www.mairetecnimont.com/en/investors/results-and-presentations/financial-results). The presentation shall also be made available on the 1info storage mechanism (www.1info.it).

***

Dario Michelangeli, as Executive for Financial Reporting, declares - in accordance with paragraph 2, Article 154-bis of Legislative Decree No. 58/1998 (“Consolidated Finance Act”) - that the accounting information included in this press release corresponds to the underlying accounting records.

The Interim Financial Report as at 31 March 2019 will be available to the public at the registered office in Rome, at the operative office in Milan, at Borsa Italiana S.p.A., on the Company’s website www.mairetecnimont.com (in the “Investors/Results and Presentations/Financial Results” section, and on the authorized storage device “1info” (www.1info.it), according to the timing allowed by law.

This press release, and the “Outlook” section in particular, contains forecasts. The declarations are based on current estimates and projections of the Group concerning future events and, by their nature, are subject to risk and uncertainty. Actual results may differ significantly than the estimates made in such declarations due to a wide range of factors, including the continued volatility and further decline of the capital and finance markets, raw material price changes, altered economic conditions and growth trends and other changes in business conditions, in addition to other factors, the majority of which outside the control of the Group.

Maire Tecnimont S.p.A.

Maire Tecnimont S.p.A., a company listed on the Milan Stock Exchange, is at the head of an international industrial group leader in the transformation of natural resources (plant engineering in downstream oil & gas, with technological and execution competences). Through its subsidiary NextChem it operates in the field of green chemistry and the technologies to support the energy transition. Maire Tecnimont Group operates in about 45 countries, numbering around 50 operative companies and a workforce of approximately 6,300 employees, along with approximately 3,000 professionals in the electro-instrumental division. For more information: www.mairetecnimont.com.

Institutional Relations and Communication

Carlo Nicolais, Tommaso Verani

public.affairs@mairetecnimont.it

Media Relations

Image Building

Simona Raffaelli, Alfredo Mele,

Ilaria Mastrogregori

Tel +39 02 89011300

mairetecnimont@imagebuilding.it

Investor Relations

Riccardo Guglielmetti

Tel +39 02 6313-7823

investor-relations@mairetecnimont.it