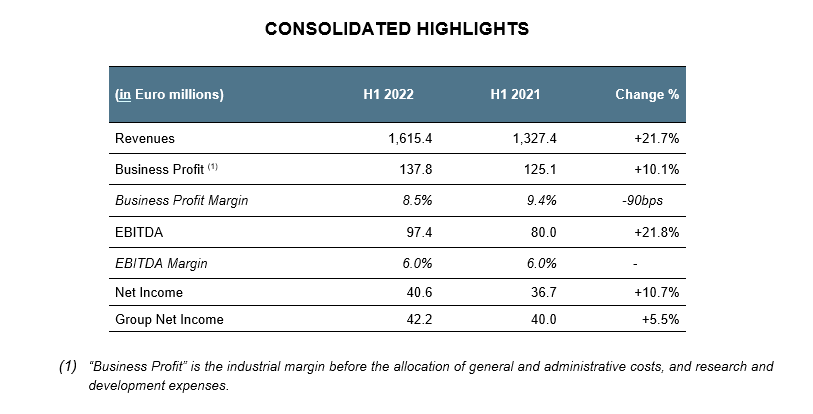

- Strong growth in the economic and financial KPIs

- Revenues: €1,615.4 million (+21.7%)

- EBITDA: €97.4 million (+21.8%); 6.0% margin

- Net Income: €40.6 million (+10.7%)

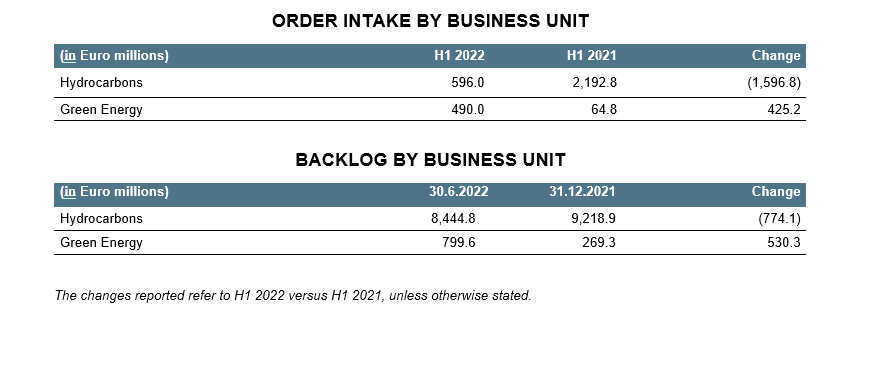

- Significant growth of the Green Energy business: the backlog increases 3 times to approximately €800 million

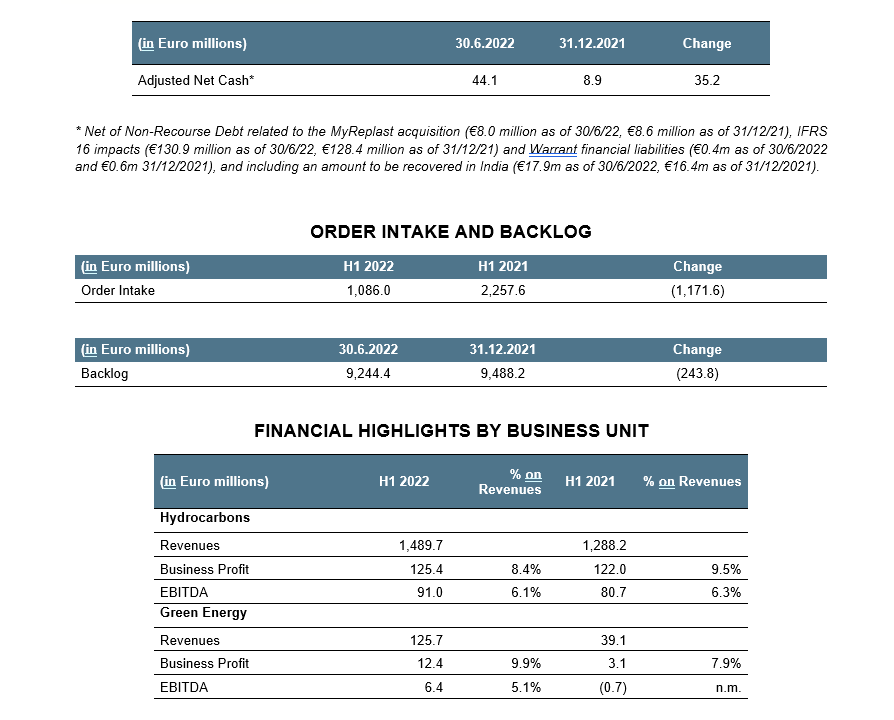

- Adjusted Net Cash of €44.1 million, up €35.2 million, thanks to a €149 mil-lion operating cashflow generation

- Backlog of €9.2 billion (79% in Gas Monetization and Energy Transition)

- Commercial Pipeline of €52.7 billion, of which €7.5 billion related to the Green Energy business

Milan, 28 July 2022 - Maire Tecnimont S.p.A.’s Board of Directors has reviewed and approved today the Half Year Financial Report as of 30 June 2022, which shows a Consolidated Net Income of €40.6 million.

Consolidated Financial Results as at 30 June 2022

Maire Tecnimont Group Revenues were €1,615.4 million, up 21.7%. Higher volumes reflect the expected progress of the projects included in the large backlog thanks both to the progression of existing projects towards phases which can generate higher volumes, and to the start of recently acquired projects.

Business Profit was €137.8 million, up 10.1% with a margin of 8.5%.

G&A costs were €36.4 million, down 11.3% as result of the efficiency process of the organization, with a cost ratio of 2.3% vs. 3.1%.

EBITDA was €97.4 million, up 21.8% thanks to higher revenues and lower G&As. Margin is 6.0% in line with the previous period.

Amortization, Depreciation, Write-downs, and Provisions were €25.7 million, up due to the amortization of new assets instrumental to the digitalization process of the Group and due to higher provisions for credits, as a consequence of the Russian-Ukrainian crisis which has impacted on the ratings of some customers.

EBIT was €71.7 million, up 20.7%, with a margin of 4.4%.

Net Financial Charges were €13.7 million, vs. €6.1 million. The First Half figure was impacted from the negative net valuation of derivative contracts of €0.8 million vs. a positive valuation of €6.8 million, with a net negative change of approximately €7.6 million. The H1 2022 item was also affected by the unfavorable trend in exchange rates and equity valuations due to market tensions caused by the Russian-Ukrainian crisis.

Financial charges, net of the aforementioned effects as of 30 June 2022, slightly increased as a result of interest owed on a higher gross debt, partially compensated by a higher level of deposits.

Pre-tax Income was €58.0 million, and the tax provision was €17.4 million.

The effective tax rate was approximately 30.0%, down 120bps mainly due to the various jurisdictions where Group operations have been carried out.

Consolidated Net Income was €40.6 million, up 10.7%, as explained above. Group Net Income was €42.2 million, up 5.5%.

Adjusted Net Cash (net of the above-mentioned values included in the footnote on page 2) was €44.1 million as of 30 June, 2022, up €35.2 million vs. 31 December, 2021, thanks to a cash generation of €149 million, and taking into account a dividend payment of €60.1 million for FY2021, and the negative impact of the mark-to-market valuation of the FX derivative contracts for €72.1 million. The latter change is the result of the evolution in exchange rates, mainly of the US Dollar against the Euro during the First Half of 2022 due to the Russian-Ukrainian crisis. The negative mark-to-market will be offset by future operating cash inflows for the same amount.

Consolidated Shareholders’ Equity was €467.9 million, down €59.5 million vs. 31 December, 2021. Notwithstanding €40.6 million Net Income, and a positive variation of the Translation Reserve of the Group’s foreign Financial Statements for €37.5 million, this item was negatively affected by the changes in the Cash Flow Hedge Reserve for €80.0 million, and by the dividend payment of €60.1 million for FY2021.

Performance by Business Unit

Hydrocarbons BU

Revenues were €1,489.7 million, up 15.6%, due to the same reasons commented above. Business Profit was €125.4 million, with a margin of 8.4%. EBITDA was €91.1 million with a margin of 6.1%.

Green Energy BU

Revenues were €125.7 million, up 221.2%, also thanks to a constant growth in NextChem’s activities driven by several partnership agreements signed with various Italian and international counterparties, and to the inclusion of recent projects and initiatives that are characterized by a green component but which were not previously included in this BU.

Business Profit was €12.4 million, with a margin of 9.9%. EBITDA was €6.4 million with a margin of 5.1% vs. -€0.7 million. Such an improvement is due to higher revenues and to a different production mix.

Order Intake and Backlog

Thanks to €1,086.0 million of new orders generated in the First Half of 2022, the Group’s Backlog on June 30, 2022, was €9,244.4 million, of which around 79% is represented by gas monetization and Energy Transition projects.

In particular, the main projects awarded to the Group in the first half include the following:

- An EPC contract with Covestro, for a new aniline plant in Antwerp, Belgium, worth approx-imately €250 million;

- An EPCM contract for the realization of a Blue Ammonia plant in the United States for ap-proximately USD230 million;

- An EPC contract for a Green Hydrogen Plant in India;

- New awards and change orders for a total amount of approximately €450 million for licens-ing, engineering and procurement services as well as engineering, procurement and con-struction activities in Europe, North Africa, the Middle East, Asia and North America.

Subsequent events after 30 June 2022

- On 7 July, 2022, Maire Tecnimont was awarded a USD300 million low-carbon ammonia synloop EPC in the Middle East;

- On 11 July, 2022, NextChem was awarded a Basic Engineering study by Storengy (Engie) for a new way of producing bio-methane from pyrogasification of waste wood.

Outlook

The general market context is still significantly impacted by the consequences of international geopolitical tensions and, to a lesser extent, by the Covid-19 pandemic. As such, it continues to remain critical and uncertain in relation to the overall raw materials price increases and their availability, transport logistics, and procurement.

In a scenario of increases in the price of natural resources, driven by a strong recovery of the energy demand, the willingness to invest in infrastructures for the transformation of natural resources has remained unchanged, thanks to a strong global demand for several commodities which has maintained prices at levels never seen before. This is also due to the lack of production originating in the countries impacted by the current conflict, which has particularly affected the Western economies.

This is confirmed by the projects awarded to the Group in the First Half 2022 and the days immediately after closing the first half accounts, which led the Group’s highest backlog levels ever, and were characterized by a greater geographical diversification than in the past.

The drive to reduce the carbon footprint leads the Group to strengthen the integration between the traditional downstream technologies and a wide range of newly green tech solutions, both proprietary and jointly developed with leading worldwide partners. Thanks to the strengthening of its proprietary technological skills, NextChem continues to pursue the industrialization of new technologies in the areas of circular economy, bioplastics/biofuels, CO2 capture, hydrogen, and green fertilizers.

The technological investments which will allow our Group to remain at the forefront of the energy transition, in addition to an effective commercial strategy, have led to the first contracts in the Green Energy BU with domestic and international clients. A growing commercial pipeline is expected to deliver additional projects in the months ahead, also taking into account the awards of feasibility studies which are expected to evolve into more significant initiatives thanks to the financial backing of European Union and/or national funds for innovation and the energy transition.

The evolution of the European sanctions since the beginning of the Russian/Ukrainian crisis to date has made the advancement of the Russian projects increasingly more difficult to continue, and it led to the gradual suspension of almost all of the operational activities as of the end of the First Half of 2022.

Taking into account what was stated above, and assuming that the pandemic does not worsen, it is expected that the other significant projects in the backlog located in areas not impacted by the current conflict may show higher production volumes than originally forecast. Such an increase which has already started in the First Half, will take place in the projects’ initial phases of engineering and procurement of critical equipment. Therefore, even though the new projects have a different phasing than the more advanced Russian ones, a strong growth in volumes this year is expected this year, albeit more concentrated in the second half, leading to a confirmation of the guidance communicated to the market on February 25, 2022.

***

Update on the Group’s exposure in the Russian Federation

As already reported, the sanctions introduced at the end of February as a result of the Russia-Ukraine crisis have started to cause a slowdown in operational activities on projects underway in the Russian Federation.

The evolution of the European sanctions framework, which has continued from the beginning of the crisis until the present, has made it increasingly complex to continue carrying out project activity, to the extent that almost all operational activities were gradually suspended by the end of the first half of this year.

The operating resources involved have been gradually redirected to the other numerous projects in the backlog from which more production is expected in the coming months than originally planned.

As of 30June, 2022, the Russian backlog amounted to approximately €1 billion, or about 11% of the total, which would have been carried out, under normal operating conditions and thus before sanctions, in the period 2022-2024.

The Russian projects’ financial position continues to be in equilibrium, and no substantial changes to this situation are expected to occur even when the projects should be terminated.

In order to carry out an assessment of the possible implications of the Russian-Ukrainian crisis, an analysis has been prepared to highlight the status of the Group's economic and financial exposure related to the projects located in the Russian Federation.

The results of this analysis, on the basis of currently available information, did not reveal any critical issues regarding the criteria adopted for the preparation of the financial statements, nor did they reveal any losses on the figures therein.

***

Update on the Euro Commercial Paper Programme

With reference to the Euro Commercial Paper Programme for the issuance of one or more non-convertible notes launched by the Company and announced to the market on 16 December, 2021, as of 30 June, 2022, the program has been utilized for an amount of €50.1 million: €29.1 million have expired and have been repaid in the current month, while €21 million will expire in September 2022. The weighted average interest rate is approximately 0.469%.

***

Webcast Conference Call

The H1 2022 Financial Results will be presented today at 5:30pm CEST during an audio-webcast conference call held by the Top Management.

The conference call may be followed as a webcast by connecting to the website (www.mairetecnimont.com) and clicking on the “H12022 Financial Results” banner on the Home Page or through the following url:

https://87399.choruscall.eu/links/mairetecnimont220728.html

Alternatively, you may participate in the conference call by calling one of the following numbers:

Italy: +39 02 805-8811

UK: +44 121 281-8003

USA: +1 718 705-8794

The presentation given by the top management will be available at the start of the conference call in the “Investors/Results and Presentations/Financial Results” section of Maire Tecnimont’s website (www.mairetecnimont.com/en/investors/results-and" class="redactor-autoparser-object">https://www.mairetecnimont.com... presentations/financial-results). The presentation shall also be made available on the “1info” storage mechanism (www.1info.it).

***

Fabio Fritelli, as Executive for Financial Reporting, declares - in accordance with paragraph 2, Article 154-bis of Legislative Decree No. 58/1998 (“Consolidated Finance Act”) - that the accounting information included in this press release corresponds to the underlying accounting records.

The Half-Year Financial Report as of 30 June 2022 will be available to the public at the registered office in Rome, at the operative office in Milan, on the Company’s website www.mairetecnimont.com (in the “Investors/Results and Presentations/Financial Results” section, and on the authorized storage device “1info” (www.1info.it), according to the timing allowed by law.

This press release, and the “Outlook” section in particular, include forecasts. The declarations are based on current estimates and projections of the Group concerning future events and, by their nature, are subject to risk and uncertainty. Actual results may differ significantly than the estimates made in such declarations due to a wide range of factors, including the continued volatility and further decline of the capital and finance markets, raw material price changes, altered economic conditions and growth trends and other changes in business conditions, in addition to other factors, the majority of which outside the control of the Group.